December 2022: What is the True State of the Real Estate Market?

/This is the question on most people’s minds with respect to Toronto and Canadian real estate. For the last 4-6 months we have seen poor performance in the three major market indicators we look at; year-over-year average sale prices on the decline, Days on Market has gone up, and sales transaction volume is also down by a significant amount.

But do these figures tell the whole story? For those who purchased in 2021 and were looking for a quick sell in 2022, and especially those who purchased in the winter of 2022 when we saw year over year spikes of more than 20% and now want to sell, this is the story and possibly not a great one at that. But for those who have owned their homes longer and were not necessarily looking for the quick flip, the story is much less bleak if not positive.

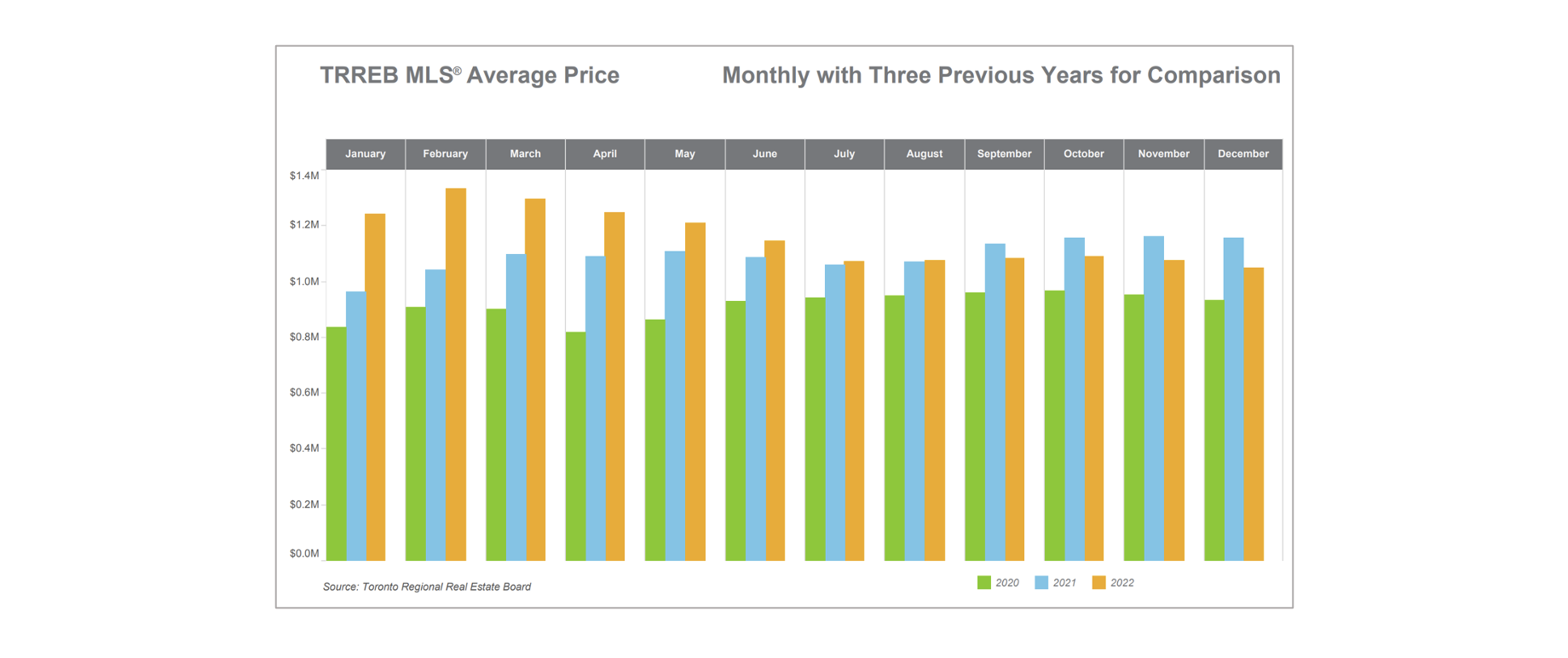

Looking at the month of December, in 2020 the average sales price in the GTA was $932,000, in 2021 it was $1,157,000 and in 2022 it was $1,057,000. Ignoring the spike in 2021, that is still a 12% increase in average price over 2 years – not bad. Stepping back and looking at the average annual sale price over the last three years, the picture is even better. In 2020 the average price was $939,000, 2021 was $1,095,000 and 2022 was $1,189,000, a 26% increase. I preface these latest numbers with the knowledge that January, February and March 2022 really raised the average home price for 2022.

Last month, in December 2022 the year-over-year average Days on Market grew 110% from 19-40 days and the number of transactions was down 48%. Prices were also down 9.2% across the GTA from the same time last year, but in Central Toronto detached homes were up 5.8% and condos up 2.4%. This speaks to the news that some areas outside Central Toronto witnessed unrealistically high sales during the pandemic, which are now unsustainable that the market has turned. Central Toronto and neighboring areas are holding their own better in these times as location, accessibility to transit, walkability, scarcity of land, and a vast array of other reasons prove why the area is less cyclical.

What does this mean for 2023? Prices in the first quarter of 2023 will drop significantly compared to the previous year. It is impossible to see anything else considering how much prices exploded in January through April 2022. Furthermore, as Royal LePage reports prices in both freehold (detached, semis, townhouses) and condos will be flat this year compared to last. I tend to agree that this winter will see a further cooling off period while the Bank of Canada decides what to do with interest rates and buyers and sellers wait for more certainty in the market. In the second half of 2023 we will possibly see the Bank of Canada temper their interest rate hikes, which should spur a rebound in the market and lead us into a more ‘normal’ 2024. The reality is that even though the foreign buyer tax and vacant home tax have come into effect in Toronto, there is still massive immigration, low unemployment, and a large shortage of homes.

In all, Toronto still remains a very good place to invest in real estate. But as always, you need to be prudent, understand your objections and budget and get good, strong advice from a balanced real estate professional who understands the market and has your best interests in mind.

Commentary by Joseph Robert, Broker of Record