November 2022: Interest Rates Continue to Impact Sales

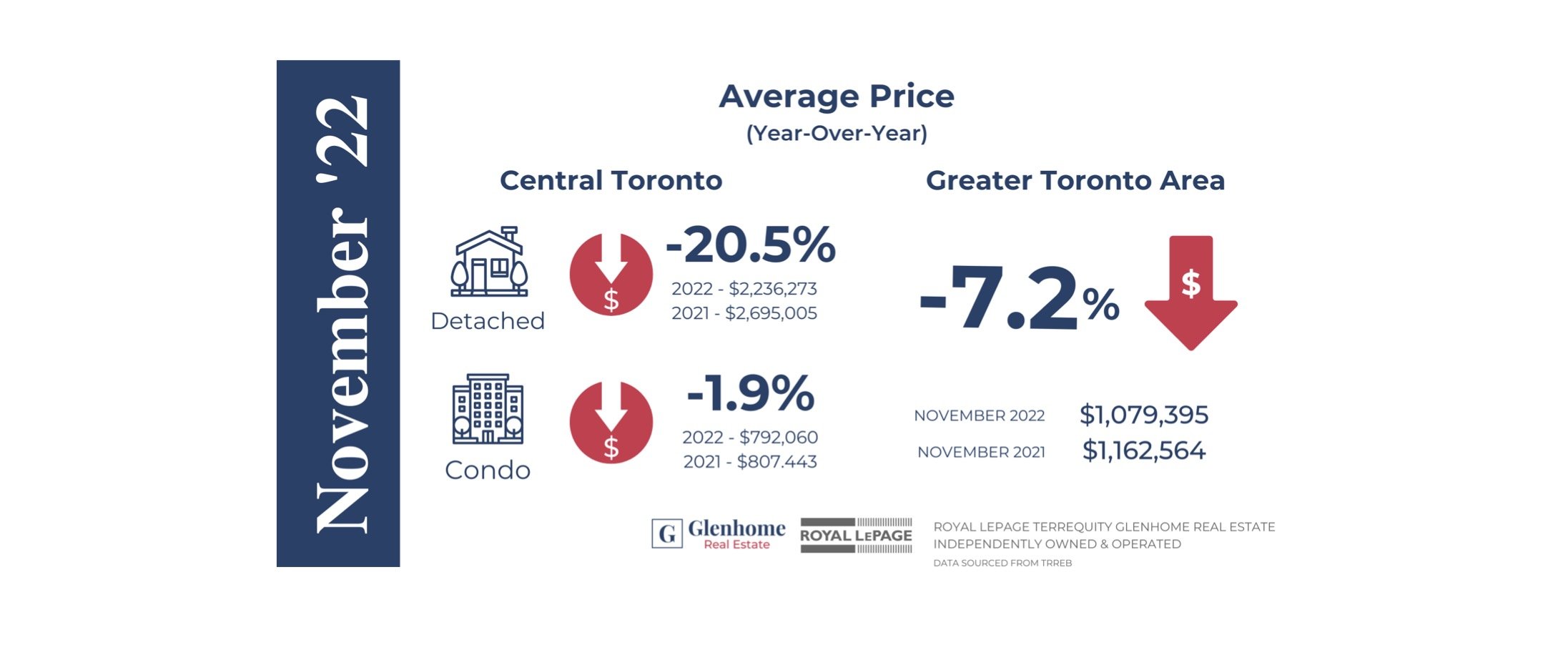

/The sales figures for November 2022 continued the downward trend we’ve witnessed this year since interest rates were first hiked in the spring. Since the height of the market in February 2022 average prices have now dropped from $1.34 to $1.08 million. With such a shift in a short period of time it can be easy to be pessimistic about the Toronto real estate market, however, we always knew a sharp increase in interest rates would temper buyer appetites and lead to less sales and lower prices in the short term. Prices may be down 7.2% from last year, but taking a longer term perspective average prices are still up 12% from November 2020. Just like the highs of the winter of 2021 was not a true reflection of the Toronto housing market, the same can be said for the lows of the fall of 2022.

What is unhealthy for real estate is a lack of consistency in the market and erratic movements in price month-by-month. When the market cannot agree on what the fair price is it makes purchasing or selling a much riskier proposition, both financially and mentally. This is why it is more important now than ever to make your real estate decisions based on sound personal financial planning. Do not buy for more than you can reasonably afford, try to sell when you want to, not when you have to, and above all never live outside your means. These are cornerstones of family and personal financial planning but are even more important when there are adjustments or minor corrections in the real estate market as there are now.