Market Update: What Happened in 2022 & What’s Next in 2023

/Getting a grasp on the ebbs and flow of the Toronto real estate market has always been difficult, a mixture of math, forecasting, experience, and hearsay, but this is especially true now as we deal with the whiplash of a two-year pandemic that turned the market on its head. You’d be faultless for asking the questions, “What’s going on and what’s going to happen?”

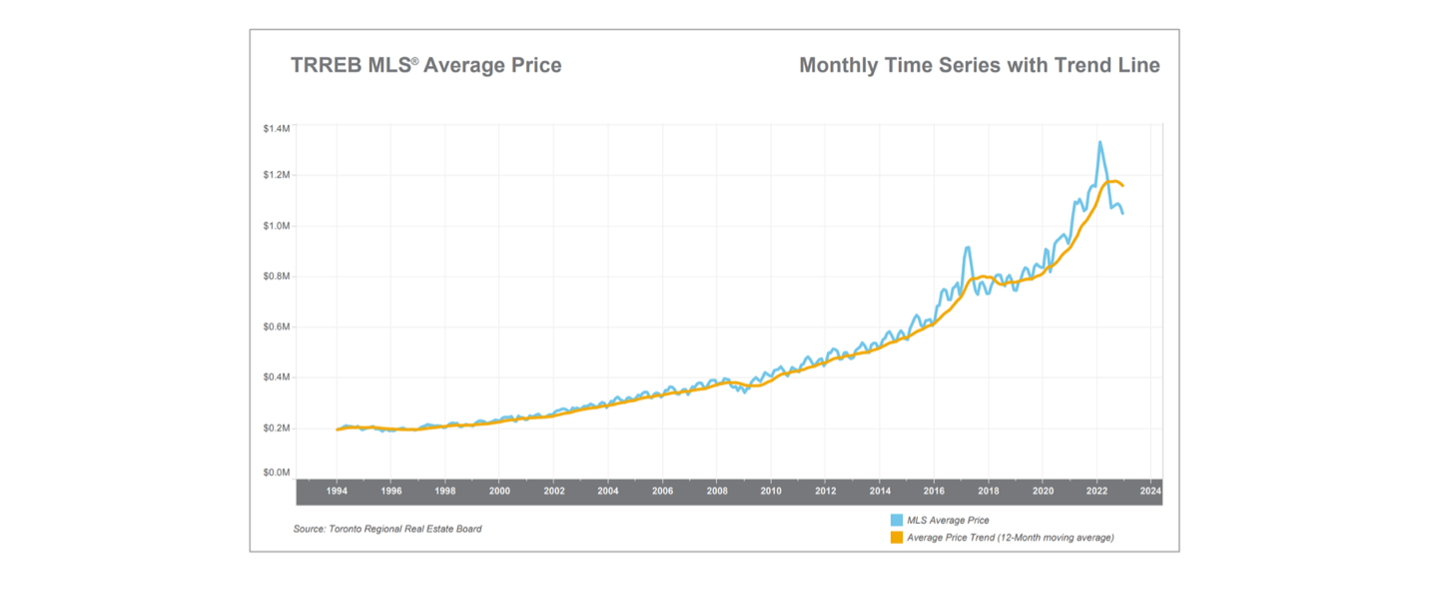

Looking back at the average price of a home in 2021 compared to 2022, on the surface it appears things are going great with yearly average prices rising from $1,095,333 to $1,189,850 respectively, an 8.6% jump. But these gains are mostly the result of the buying frenzy we saw in the first few months of 2022, which drove prices up but tapered off starting in the spring with the introduction of sudden and significant interest rate hikes.

From a different perspective, in the GTA the average price of $1,051,216 in December 2022 was down 9.2% from December 2021, and down 15.4% from January 2022. Simply put, the average price for a home has dropped significantly from the peak in February 2022. Although, prices are still higher than they were before the pandemic began.

The chart above is the Monthly Average Price in the GTA from 2020-2022 and helps show quite clearly the timeline of Toronto real estate since the pandemic began. The two most significant dates being April 2020 (first month of lockdown) and March 2022 (first interest rate hike since 2018) when the market reacted negatively in response to these major events. The difference being that in 2022 ever-increasing interest rates had a much deeper impact on prices as mortgages became more expensive and harder to obtain.

What are we seeing now? Well, the Toronto real estate market is in a very interesting position and not all is necessarily clear, particularly in the short term. In the long term, Toronto is a world-class city constantly struggling to supply enough homes to meet the demands of those moving here, so you can be sure prices will rise. In the short term, we are seeing contradicting signals that make it difficult to come to conclusions with absolute certainty about the next year or so.

Yesterday the Bank of Canada raised rates another 0.25% but indicated it is not planning on raising them further. Could this signal we are potentially at the bottom of the market and prices will start to rise? Potentially, but it may take a few months for the market to respond in turn.

On the ground, home prices have held up much better in Central Toronto than those areas outside the city, up 5.8% for detached houses and 2.4% for condos from the same time last year. The market is also much fairer for buyers now than it has been in any recent history with sales often going for close to or under asking, and conditions, such as financing and home inspections, being accommodated.

That’s not to say it isn’t still competitive out there for buyers. The number of available listings was down 21.3% in December 2022 from last year, so there aren’t that many options and the good places go quickly if they are priced well. But one of the biggest hurdles right now for buyers and sellers is determining what is the right price. Should we look at sales in the peak or the valley for comparison?

What’s next? That’s up for debate. It’s good that interest rates have stabilized so Canadians can prepare accordingly and have a better expectation of where prices will settle at. In turn, hopefully this also helps give homeowners the confidence to list their properties no longer fearing that they may be selling at a low point. Consensus amongst experts seems to be that 2024 looks promising for Toronto real estate and we will be back to business as usual soon enough. 2023 on the other hand looks to call for cautious optimism. But remember, no matter when you get into the market make sure to take your time, do your due diligence, and always rely on trusted advice.

Commentary by JR Robert, Sales Representative