March 2024: Market Update

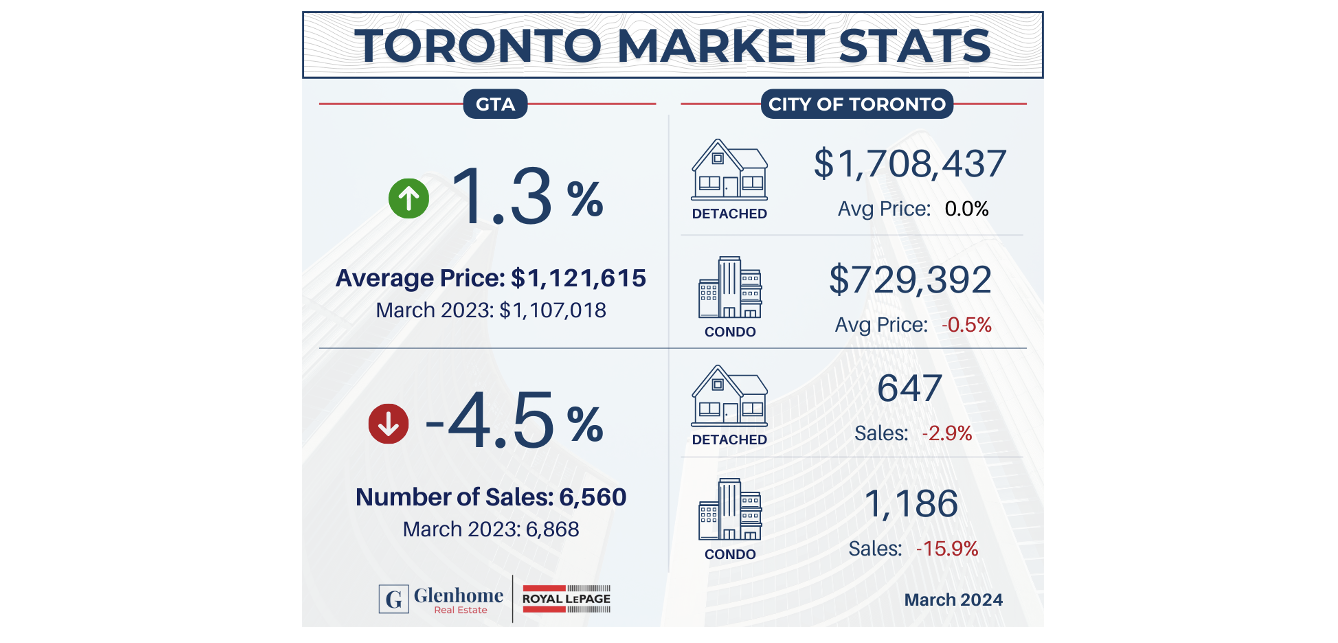

/A few weeks into April and it feels like spring is trying it’s best to really start despite the inclement weather we’ve been having, but I guess there’s the saying, “April showers bring May flowers” for a reason. Reflecting back on the Toronto real estate market last month, in the GTA we saw the number of sales drop by 4.5% compared to March 2023 and despite listings being up 15%, overall home prices still rose modestly up 1.3%.

Many eager sellers came to market in March hoping to get a jump on the spring market as the weather looked good and there was the expectation that interest rates might soon be coming down providing more favourable buying conditions. But although we saw healthy competition among buyers helping prices to increase, many would-be buyers continue to wait on the sidelines for interest rates to come down and mortgage rates to settle leaving many listings sitting unsold.

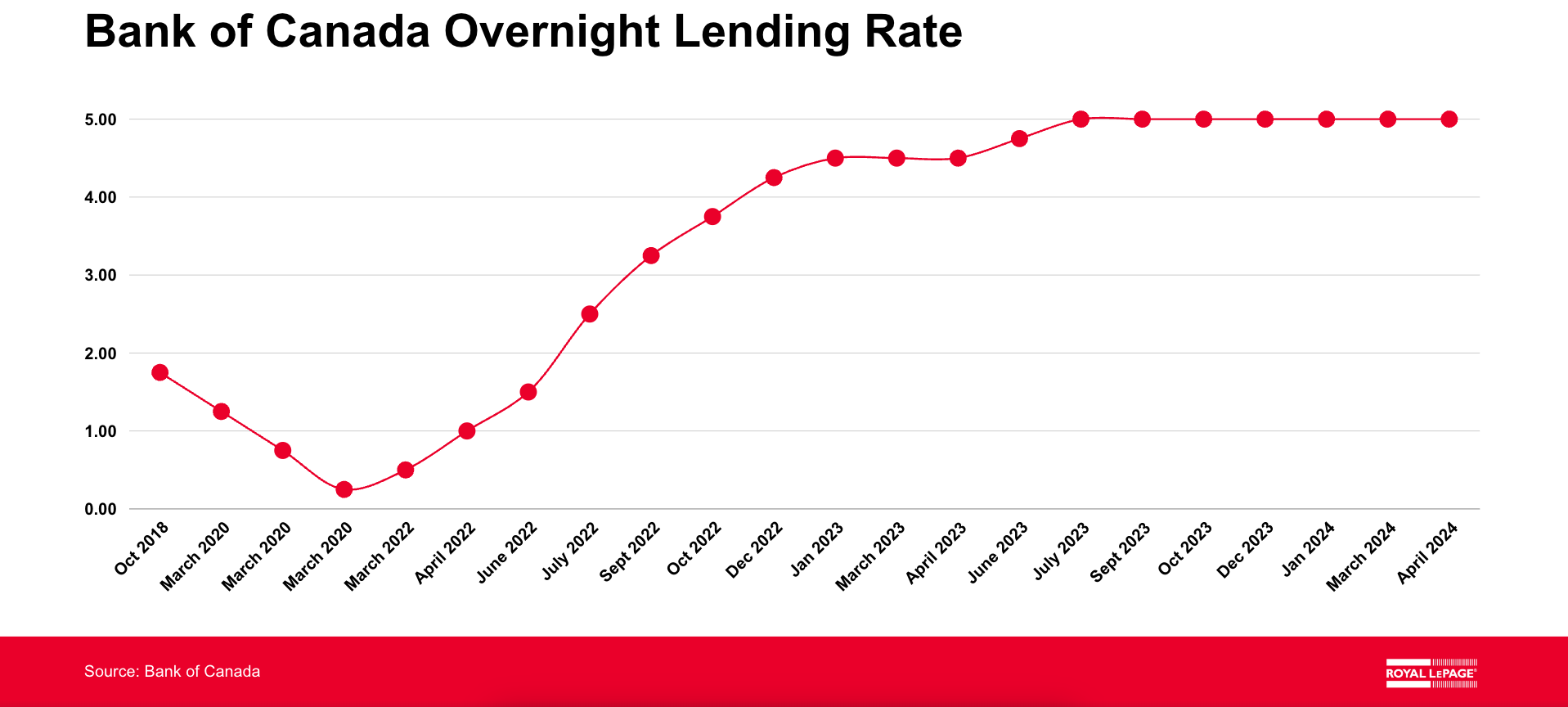

In its third interest rate announcement for 2024 last week, the Bank of Canada held its overnight lending rate at it’s current level of 5.00% .This marks the sixth consecutive hold since July 2023, prior to which rates have been increasing from the low of 0.25% since March 2020. Depending on who you ask, sentiment seems to be that there will be at least one rate cut by the end of the year, with one possibly as early as June 5th when the next rate announcement is made. However, we aren’t prepared to make any assumptions until the Bank of Canada provides some more concrete guidance as to what they intend to do. The expectation continues to be that if and when rate cuts are announced, buyers are going to flood the market and home prices will rise in turn with the demand.

Despite somewhat tepid figures for the overall market in March, looking more closely we actually saw ‘semi-detached’ houses and ‘townhouses’ perform quite well, particularly in Central & East Toronto. In Toronto prices for semi-detached homes were up 3.0% and townhouses up 2.5% compared to last year, with sales up 9.9% and 5.3% respectively. With historically high prices and interest rates, we expect this trend to continue in these markets as families consider options that are more affordable than a detached house with more space to grow into then a condo. See the chart in ‘Market Stats’ for more details.

Looking ahead to April, we have not seen the spring market take off yet but things are starting to move. There’s been healthy competition between buyers so far, which will only continue as the weather improves and people look to close a deal before we’re into the summer. In the luxury market we aren’t seeing the same urgency from buyers who tend to be less interest rate sensitive. However, there have been some notable high-end sales lately, particularly in Rosedale, showing that luxury buyers are still interested but only if it’s for the right property, otherwise they’re willing to wait.

All-in-all we find ourselves in a fairly balanced market between buyers and sellers right now without much of an upper hand being given either way. Saying that, there are plenty of anxious would-be buyers out there waiting for the right place at the right price. Once mortgage rates come down we expect to see an influx of competition that will inevitably drive prices up, but when that time will come is anybody’s guess.

Click here to read TRREB’s MarketWatch Report

Market Commentary by Joseph Robert, Broker of Record and JR Robert, Sales Representative