April 2024: Market Update

/In this issue:

April 2024 Market Update & Market Stats

Rental Market Update 2024 | Q1

8 New Housing Policies Announced in the 2024 Federal Budget

Toronto Real Estate Market Update

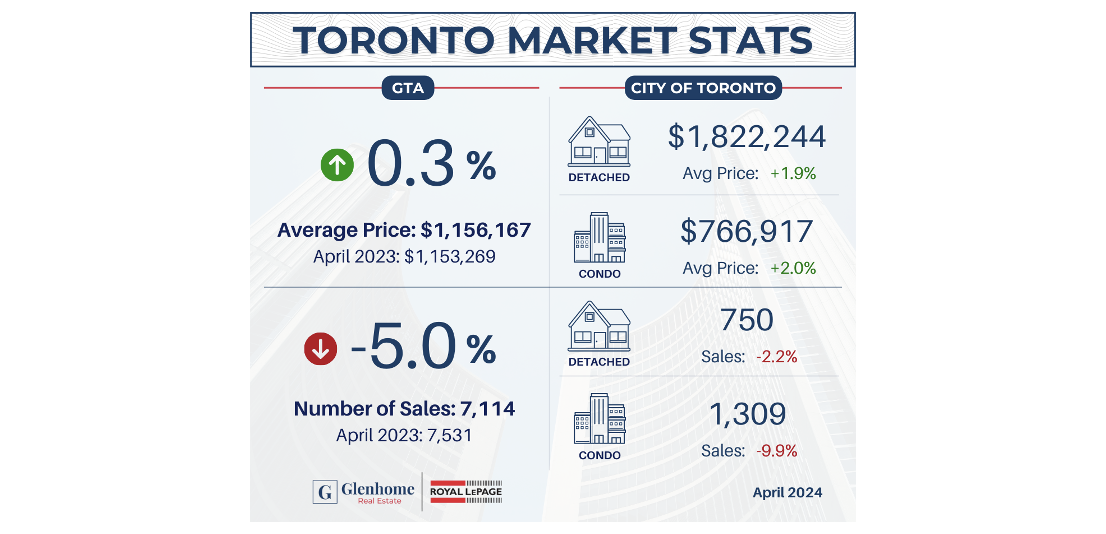

The April 2024 Toronto market stats came out last week and it’s very interesting to see how the housing market was faring this Spring as anecdotally there was chatter of higher interest rates and late-winter weather potentially keeping buyers on the sidelines when the month started. Now that we’re into May, upon review overall sales in the GTA were down -5.0% compared to April 2023 with overall prices remaining steady at 0.3%.

These results seem to suggest the Toronto housing market was quite tepid last month, however with some context, we know that there was a temporary post-pandemic market resurgence last April 2023 that is making this year’s results look lacklustre by comparison.

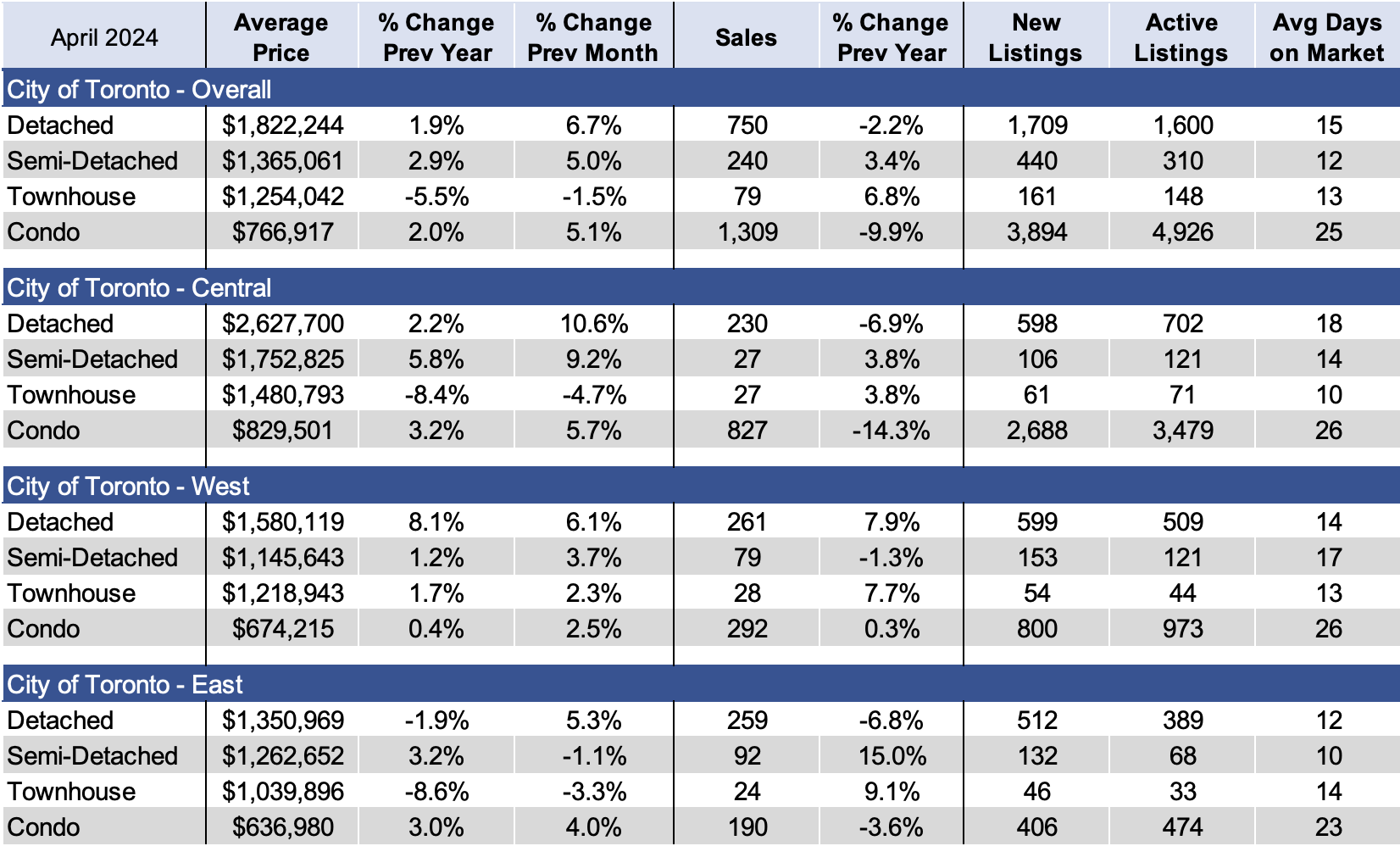

In reality the real estate market in Toronto is performing pretty well this year with prices appreciating and sales improving on a monthly basis. If you look at the expanded ‘Toronto Real Estate Stats’ table below you will see that almost all areas of the city and most home types appreciated in April with detached homes in Central Toronto outperforming.

Despite a robust Spring market so far, there were also many homeowners who waited out the winter and were eager to list come March/April, so we saw an increase of 74.4% in active listings compared to last year. The gluttony of supply is offering buyers more choice, which in turn is helping to keep prices down as supply outweighs current demand. This paired with the wait for interest rate cuts from the Bank of Canada is leaving buyers without the same sense of urgency we typically see in Toronto. The result is that despite healthy market interest many properties are remaining on the market longer than expected and we may see the ‘spring’ market continue well into the summer.

Click here to read TRREB’s MarketWatch Report

Luxury Market Report: 2024 | Q1

There has not been a lot to report on in the Toronto luxury market with sales pretty much flat and no significant activity to make note of. There have been a number of listings and high-end buyers aren’t necessarily waiting for interest rates to come down like the rest of the market, but they also don’t typically feel the pressure to make a move unless the right property comes out.

Rosedale did perform well lately because of a large $15M sale (on a $11.5M ask) with multiple bidders having only been on the market 5 days, which shows high-end buyers are willing to pay for the right property these days. But there have only been 3 high-end sales this year, down from 5 last year, with a great deal of inventory gaining days on market.

Lawrence Park continues to be lagging behind 2023 with properties going for less and overall dollar volume transacted being down too. There seems to be very little urgency in the area right now, perhaps giving buyers a slight edge as the summer draws closer.

Forest Hill has fewer trades so one sale can drastically skew the monthly sales figures (the same can be said for all of these neighbourhoods really) but the area saw sales prices appreciate in general by 17.8% with the same number of sales when compared with January-April 2024 vs. 2023.

The Bridle Path has been slow all year with no sales to note and no significant updates to report. Unless of course you’re Drake whose property had some unsolicited showings last week.

Condo Market Report: 2024 | Q1

Each quarter the Toronto real estate board (TRREB) releases its report on the GTA condominium apartment market. In the first quarter of 2024 condo sales increased by 5.3% compared to Q1-2023 but so too did the number of new listings by 23.3%. This resulted in the average condo price in the GTA declining by -1.0% to $693,754 year-over-year as buyers benefitted from more choice. In the City of Toronto, which accounts for most condo sales, the average selling price was down -0.5% for an average of $723,186.

In the ‘new condominium market’ (often referred to as pre-sale condos) the Greater Toronto Hamilton Area (GTHA) reported 1,461 sales in Q1-2024, the lowest quarterly total since the Global Financial Crisis in Q1-2009 (884 sales). Outside of that brief period in early 2009, new condominium sales haven’t been this low since the late-1990s.

Developers dramatically pulled back on new launches in early 2024, with only four projects totaling 958 units brought to market in the first quarter. Three out of the four projects launched in the GTHA during Q1 were in the 905 Region, resulting in an average opening price for new condos of $1,168 psf — down 12% from Q4-2023 ($1,333 psf) and a 17% drop from the record high in Q1-2023 ($1,407).

“The market for new condominiums started 2024 where it ended off in 2023, very slow. After two years of preconstruction sales trending down sharply, construction activity is being hit hard. While anticipated reductions in interest rates in the second half of the year should lead to some improvement in market conditions for new condominiums, activity will likely remain subdued as the industry works it way through current inventory and digests the numerous government policies on housing recently released,” — President of real estate insights provider Urbanation, Shaun Hildebrand

Click here to read TRREB’s Q1-2024 Condo Market Report

Click here to read ‘GTHA New Condo Sales Fall 71% Below 10-Year Average' by Urbanation

Market Stats: April 2024

Average Monthly Prices

Toronto Real Estate Stats

Rental Market Update: 2024 | Q1

Looking at the rental market in the GTA last quarter (January-March 2024) apartment prices were down -2.9% compared to the same time last year, and rent prices on the whole have actually been on the decline lately, down a total of -11.8% since Q3-2023 — the largest six-month decrease recorded during the past 15 years of data tracking outside of the pandemic period in late 2020/early 2021. It’s hard to celebrate too much considering the average monthly rent for 1, 2 and 3-bedrooms apartments was still $2,441, $3,139, $3,929 respectively last quarter, but it’s nice to see a momentary pause in rent inflation for the time being.

The reason prices have come down and are holding steady for the most part is because of the sheer number of rental listings that have come to market recently greatly outweighing demand from prospective tenants. From January to March 2024 (Q1-2024) there was a total of 29,075 rental listings and of those only 13,390 were leased, a lease rate of about 46%.

Supply from newly completed condos made a significant impact on the rental market. Over the past four quarters, a total of 23,095 new condos were registered, a 21% increase over the same period ending Q1-2023 (19,028) and the third highest four-quarter total ever recorded. At the same time, demand for rentals has been weaker because higher rents are putting pressure on tenants to seek more affordable living arrangements, or to consider buying instead if they can afford.

For now we expect rent prices to remain stable in the near term and don’t foresee prices to continue to fall much, if at all. President of Urbanation states, “While the market remains expensive with rents 15% higher than two years ago, renters waiting for some reprieve in the market have found it thanks to a temporary supply infusion from condo investors. This isn’t expected to last long, and rents should continue rising as construction falls short of demand.”

Supply will continue to be the biggest determining factor in where rent prices go next but it’s tough say how the upcoming market may be impacted. Our outlook is that if interest rates cuts are announced by the Bank of Canada, soon buyers and investors will be much more interested to act quickly and we may see some of the supply dry up. Until then renters have ample time to look around and there is plenty of choice out there to find the right place, for the right place, in a great location. Just don’t expect to get any steals if you’re in the market, this is still Toronto after all.

Click here to read TRREB’s 2024 Q1 Rental Market Report

Click here to read ‘GTHA Condo Rents Down 7% in Past 6 Months’ by Urbanation

Rental Market Summary

Average Rental Prices (Q1 2019 - Q1 2024)

Rental Stats (Q1 2023/2024)

8 New Housing Policies Announced in the 2024 Federal Budget

On Tuesday, April 16th, the Canadian federal government unveiled the 2024 budget. The annual fiscal announcement detailed dozens of new and ongoing initiatives aimed at creating new housing, along with policies targeted at making renting and home ownership more affordable for Canadians. Here are 8 standout housing policies announced in this year’s budget:

Canadian Renters’ Bill of Rights

Budget 2024 announced the creation of the Canadian Renters’ Bill of Rights, which proposes several initiatives to help tenants including $15 million being allocated to a Tenant Protection Fund.Funding for the Construction of New Homes

The budget introduced initiatives to provide billions of dollars to fund the development of new rental units, new homes, and infrastructure projects to support the projects and new residents.30-year Mortgage Amortizations for First-time Buyers of New Homes

Starting on August 1st, first-time buyers purchasing a newly-constructed home can access 30-year mortgage amortizations, a product that has previously only been available to those with a down payment of at least 20%.Amendments to the Home Buyers’ Plan

To make it easier to access funds for a home purchase, Budget 2024 unveiled an amendment to the withdrawal limit on the Home Buyers’ Plan, which has been increased from $35,000 to $60,000 as of April 16th.

Support for Single-family Home Suites

To encourage the creation of secondary housing units, the 2024 budget announced $409.6 million over four years towards a Canada Secondary Suite Loan Program, run by the CMHC. This will enable homeowners to borrow up to $40,000 in low-interest loans towards the cost of adding a secondary suite to their homes.

Increase to the Inclusion Rate on Capital Gains above $250,000

Effective June 25th, Budget 2024 proposes an increase to the inclusion rate on capital gains realized annually above $250,000 by individuals, corporations and trusts from one-half to two-thirds, by amending the Income Tax Act. This would include the sale of secondary residences and investment properties. Click here for more details

New Funds for Post-War Housing Catalog

In December 2023, the federal government announced that it would be modernizing its post-war home design catalog, providing standardized home blueprints to accelerate the creation of new housing. The 2024 budget unveiled $11.6 million towards the development of 50 home designs, which includes plans for row homes, fourplexes, sixplexes, accessory units and modular homes.Conversion of Public Lands into Housing

The federal government intends to utilize public lands in order to free up space where new housing can be built, with a goal of building 250,000 new homes by 2031 under the Public Lands for Homes Plan. In Budget 2024, the government announced plans to lease public land to builders in order to lower capital costs, and review the federal lands portfolio to identify more usable lands for housing. Over the next three years, $5 million will be allocated to the Canada Lands Company to support initiatives to build properties on public lands.

Click here to read the full 2024 Federal Budget

Market commentary by Joseph Robert, Broker of Record

& JR Robert, Sales Representative