SEPTEMBER 2023: INTEREST RATES & UNCERTAINTY CREATING A MORE BALANCED MARKET

/The 2023 Toronto real estate market has been a story of ups and downs, so it will be interesting to see how the story ends as we head into the final quarter of the year. The exuberance we witnessed in the spring and early summer seemed to signal at the time a return to the typical Toronto housing market we remember not long ago, with bidding wars being the norm and prices going well above list. Houses, semis and townhouses did especially well with condos lagging slightly behind. The market subsequently slowed down as it does during the summer months with the expectation we would see a strong autumn picking up where the spring left off. However, as we are now halfway through October and well into the fall season we have not seen the same demand we did earlier this year.

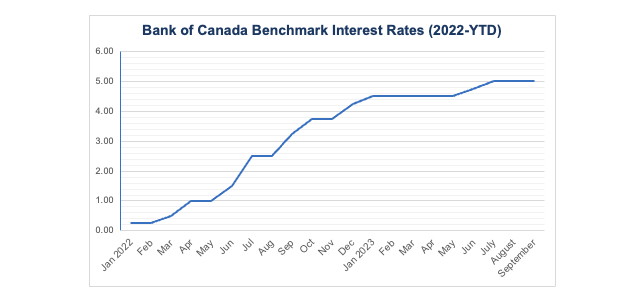

It seems that although Canadians may (begrudgingly) be getting used to the idea of higher interest rates since increases started last spring, the steep pace of these hikes coupled with the uncertainty of what might come next was weighing on the Toronto real estate market in September and into October. The Bank of Canada’s benchmark rate is now at 5.00%, up 4.75% since March 2022 and at a level not seen since 2001, putting a strain on buyers who may now be considering less expensive options or are waiting for rates to fall altogether.

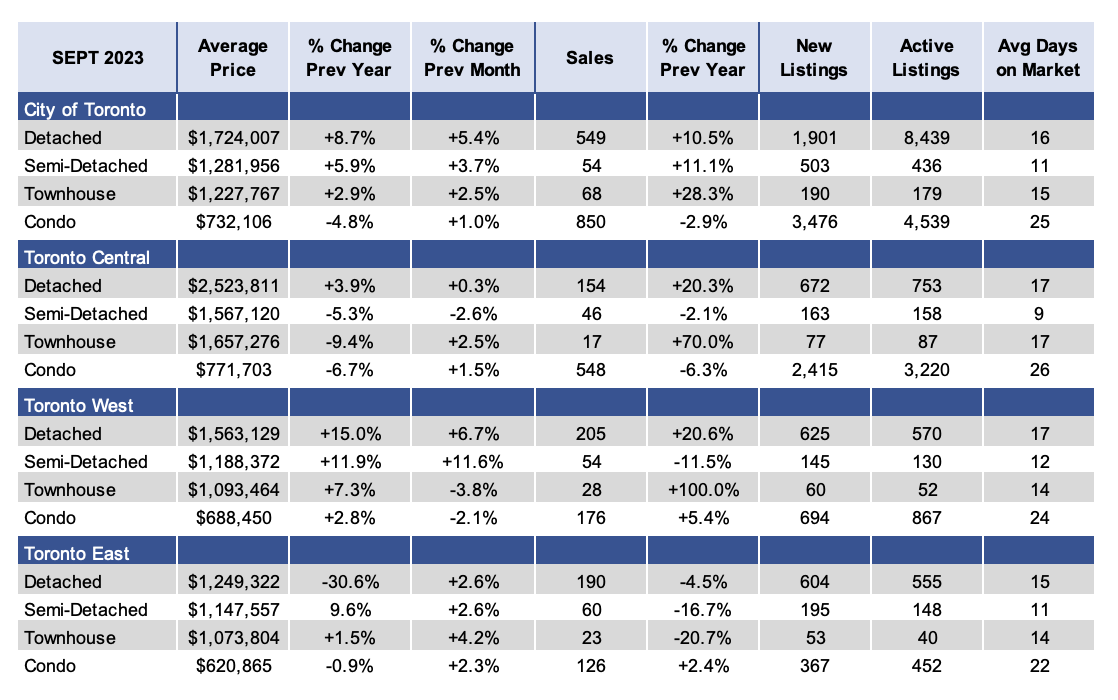

What’s good for buyers and sellers alike is that prices are stable for now, up 3.0% from September 2022. But last month we saw home sales drop by 7.1% and the number of listings jump significantly (+44.1%), a notable shift from the spring/early summer that has changed market conditions with supply seemingly outweighing demand.

The sheer number of new listings set against the backdrop of sub-optimal and uncertain economic conditions means buyers feel they can afford to look around and wait for the right place at the right price, especially when they have to pay record-high mortgage rates. The result is a more balanced market this fall in which buyers and sellers are on a relatively level playing field, with buyers perhaps having the edge as the days pass and we head into the winter months. Over the next few months all eyes will be looking to the Bank of Canada for any sign that borrowing rates will come down at which point demand will explode, the market will move starkly in the favour of sellers, and prices will rise in turn.

Earlier this month Paul Baron, President of the Toronto Regional Real Estate Board (TRREB) said, “…the consensus view is that borrowing costs will remain elevated until mid-2024, after which they will start to trend lower. This suggests that we should start to see a marked uptick in demand for ownership housing in the second half of next year, as lower rates and record population growth spur an increase in buyers.”

Phil Soper, President and CEO of Royal LePage echoed these comments saying, “Slower activity has allowed critically low inventory levels to build marginally in many regions, yet the quantity of homes available for sale in this country remains well below the level needed to keep a lid on property price increases,” Soper continued. “Once interest rates begin to ease, even by only a small amount, we expect buyers will return to the market in large numbers and the relentless upward march of home prices will begin again. At its root, housing supply remains out of step with the growing need for it.”

All else being equal, we don’t expect much to change between now and the rest of the year. Royal LePage has revised their year-end forecast and now predicts the aggregate price of a home in Canada will increase 7.0% in the fourth quarter of 2023, compared to the same quarter last year. The previous forecast (+8.5%) has been revised downward to reflect softer activity than expected in the third quarter, which resulted in a modest decline in prices in some markets, including Toronto and Vancouver.

“With activity slowing, home prices softened in some of our major markets over the last three months, following a stronger-than-expected second quarter. Prices remain up on a year-over-year basis, with today’s stable market standing in sharp contrast to the steep declines experienced in the third quarter of 2022,” said Phil Soper . “While trading volumes in most regions remain sluggish, Canada’s housing market is on solid footing, with pent-up demand building. We don’t anticipate a material change in property prices through the remainder of the year.”

The tides of Toronto real estate are always changing in the near term, but what remains constant is this incredible city of ours. The roads may look slightly different, transit lines are changing, and new buildings are going up everywhere but the life and vibrancy isn’t going anywhere! With more people coming here each year the city will continue to rapidly grow and so too will the desirability for real estate.

Market Commentary by Joe Robert, Broker of Record & JR Robert, Sales Representative

Sources

TRREB September 2023 Market Watch Report: Read Here

Royal LePage Market Trends Report: Read Here

Toronto Market Stats: September 2023